Varun Iyer's Insight: 'Why Size is the Enemy of Outperformance' A Compelling Case for Direct Investing in India

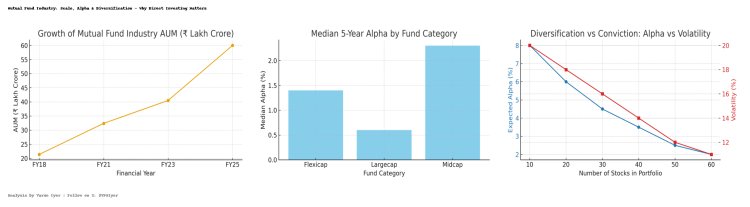

India’s mutual fund industry has become one of the most powerful forces in domestic capital markets. With total assets under management (AUM) crossing ₹75 lakh crores today, and monthly SIP inflows exceeding ₹28,000 crore, funds now own nearly one-fifth of all listed equities.

Yet, behind this impressive scale lies a paradox: as mutual funds grow, their ability to generate alpha steadily declines.

The AUM Explosion of the Mutual Fund Industry

|

Year |

Total AUM (Rs Lac Crs) |

Equity AUM (Rs lac Crs) |

Monthly SIP Inflows (Crs) |

|

FY18 |

21.4 |

7 |

6,500 |

|

FY21 |

32.4 |

12 |

8,500 |

|

FY23 |

40.5 |

17 |

13,000 |

|

FY25 |

60.0+ |

29.5 |

20,300 |

|

Sept 25 |

75.6 |

38 |

28,000 |

Source: AMFI, SEBI, industry data

The numbers show a maturing investor base. But large AUMs bring practical constraints — particularly for active fund managers tasked with beating the benchmark. This is despite the Fund managers being well experienced and researched. They key to success in investing is not about stock picking but about Portfolio Construction. That unfortunately in a large size is very difficult.

When Scale Kills Agility

A ₹50,000 crore equity fund cannot enter or exit a ₹5,000 crore market-cap company without moving the price. As a result, funds must diversify across 40–60 holdings to maintain liquidity and compliance. That limits concentration — and therefore, potential outperformance.

“As AUMs rise, generating consistent alpha over the benchmark becomes structurally difficult,” notes a senior fund manager at a leading AMC. “We’re asking investors to tone down expectations — 10–12% returns are more realistic now.”

The Missed Opportunities

Mutual funds’ layered approval processes and risk frameworks often cause them to miss early-stage sectoral rallies.

|

Period |

Sector/Stock |

Theme |

MFs Allocation |

|

FY22 |

Sugar Stocks |

Ethanol policy & margin expansion |

Entered late; missed 2x rally |

|

2015–18 |

Microfinance |

NBFC & small finance bank rally |

Mostly Underweight |

|

2010–20 |

Bajaj Finance |

Proxy to Indian Consumption |

UW till nifty inclusion. |

The Case for Direct Investing

For investors who can do the research, direct investing offers what large mutual funds cannot — focus, flexibility, and freedom. It allows one to build a concentrated portfolio of high-conviction bets and act quickly when opportunities arise.

However, direct investing is not for everyone. It requires in-depth research, sectoral understanding, and emotional resilience. Stock selection without context or conviction can do more harm than good.

That’s why many informed investors prefer to follow experienced market participants who share their analysis publicly — especially on platforms like X (formerly Twitter).

If you’re interested in reading about market insights, sectoral trends, and company-specific deep dives, you can follow me at @VPSIyer. I share content regularly for educational purposes.

Mutual funds will remain the backbone of India’s financial inclusion story. But for investors willing to learn and think independently, direct investing offers the chance to outperform — with responsibility and research as the compass.

The next wave of wealth creation may not come from the index — but from the overlooked corners of the market where conviction meets patience.

I am not asking anyone to stop their Mutual Fund Investments but only emphasizing that MF investments are no longer big wealth builders. They should be looked upon with a more rational and optimized return expectations.

Disclaimer: I am not SEBI Registered. I only share information for educational purposes.

The writer is an Independent Investor with over 15 years of Investing experience He has spotted many multi bagger stocks in the past like Varun Beverages , Polycab , Indiamart , Apl Apollo tubes , Bajaj Finance

Sources

- AMFI — Monthly Notes & AMFI Annual Report / AMFI Monthly PDF (Mar 2025) — official monthly AUM, equity AUM and SIP numbers.

- AMFI Annual Report / AMFI 2024 note — AUM jump to ~₹54.1 lakh crore in FY24.

- Crisil / AMFI Factbook (AMFI Factbook 2024) — equity AUM series (Mar-2019 = ₹7.00 lakh crore; Mar-2024 = ₹23.49 lakh crore) and trend analysis.

- Economic Times / press (reporting on AMFI data) — Equity AUM = ₹29.45 lakh crore and highest ever equity inflows ₹4.17 lakh crore in FY25; used to confirm FY25 equity numbers.

- AMFI / Industry dashboards (Sept 2025) — AUM reached ₹75.61 lakh crore as of Sep 30, 2025 (industry dashboards / Franklin Templeton summary).